Asia's third largest economy's currency, Indian Rupee (INR) tumbled to its lowest ever level of 60.76 per Dollar on 26th of this month.

Indian Rupee like most of the emerging markets currencies including South African Rand, Brazilian Real has been under the hammer from the time Federal Reserve chairman Bernanke hinted a slow down in the printing press or Quantitative Easing (QE) which is flooding insane $85 Billion per month in purchasing bonds and mortgages.

This money is indirectly entering the emerging markets like India. Unwinding of QE will definitely result in huge sell off of these already beaten down currencies, pushing them down even further.

Rupee has got a temporary respite from

- RBI's data that Current Deficit (CAD) of India for the first quarter of 2013 narrowed down to 3.6% of GDP as against 6.7% in its preceding quarter.

- The USA's GDP expanded at 1.8% from January to March, down from a previous estimate of growth of 2.4%.

What will happen then ?

If you are too smart and over intelligent, you would probably be thinking that this is a great situation, All is well !!

How ?

Hmm, if one dollar is worth lets say, one trillion rupees, if I export one dollar worth of goods, for instance a mango, I'll get trillion rupees!!

Whoa I become a trillionaire just by selling a mango!! This is ridiculous , ok, let me buy a dozen of mangos this time, what will it cost ? Rs.50 ? Uh who cares? I'll give a tip of Rs.1000 and export them to get 12 trillion rupees. This is wonderful, I need not go to work next morning !!

Well you are right and congrats for becoming an overnight trillionaire and joining the league of Ambani's. Don't even bother to resign your job, let them fire you. You can anyways go in your free time and buyout that company itself !!

Things are great, but there is a small problem.

Next morning, when you open your door to pickup the news paper, you'll not see it.

why ? Newspaper boy made Quadrillions by selling Apples !! why would he bother to do this job now ?

On the flip side, you'll have to pay a trillion rupees to an imported item which costs just one dollar.

Try going to hotel, a cool drink which used to cost Rs.10 will now cost Rs.10 trillion.

Your maid who used to work for Rs.5000/month will now charge Rs.5000 trillion. Don't worry your salary will also get increased in your company.

This is the problem if everyone becomes millionaires !!

On a side note, If somebody tells you that a country will become prosperous if ever citizen in that country becomes rich, then it's a crap. You now know why.

Remember, there will be no value for a good looking and charming girl, if every girl around is as good looking and charming !!

Soon everyone will realise that nothing much has changed.

If we look at it, we have done nothing more than, just replacing numbers right ?

We have replaced Rs.1 by Rs.1 trillion. That's it. Everything else is functioning the way it was.

So, again all is well right ?

NO.

We have not yet discussed the real problem.

We have started to live in Hyperinflation and our currency is just one step away from getting devalued, Redenominated and completely thrown to the dustbins garbage very soon.

What ? We have just replace Rs.1 by Rs.1 trillion, tomorrow we will replace it by Rs.100 trillion, our income is also increasing by that standard, why should this create an hyperinflation and currency devaluation ?

This is an hyperinflation because,

- our savings have eroded. Rs.5 Million one must have had in his bank account was more than enough to buy a nice flat and a car, which is now almost worthless.

- Our income will not increase with the pace of our falling currency.

Demand for our currency in foreign exchanges comes down, as those who held our currency previously have made huge losses, no new buyer will come forward.

So we can't import any products from outside, as we need to exchange our currency to buy foreign currency.

It will difficult for government to raise funds by issuing instruments like bonds, it will have to pay huge interest on these bonds. Which again compels to print more money and further devaluation of it.

Finally everyone stops recognising our currency and it will be worth nothing more than toilet papers!!

Well if you are laughing, thinking what kind of crap story is this guy telling, and these things have never happened or will never happen, then read on, this article is written exactly for you.

Fiat economy in which we are living has its problems. Currency failures are more frequent than one could imagine. To name some, Germany, Argentina, Peru, Hungary, Chile, Angola, Belarus have all had their currencies declared useless. See the full list here.

The most recent being the fall of Zimbabwe dollar on 12th April 2009. So, lets just go back few years and see what really happened.

You have to believe, when Zimbabwe dollar came to circulation in 1980, it was valued higher than USD. Just one man Robert Mugabe single headedly eroded its value with the able support of the Central Bank Governor Dr. Gono. These two have shown the world, how not to run a country and how not to run a central bank.

Dr.Gideon Gono, who had crashed Zim Dollor in his five year term from 2003-08, was controversially reappointed in 2008 by Mugabe to complete the unfinished job.

Till 1998, Inflation was hovering around 20%. This was high but still was under control.

While some positive inflation is healthy but when it starts to cross a certain level (RBI likes to keep it below 5%) things become uncomfortable.

This is where central banks come into the picture and start to check the flow of money into the system. It raises the interest rates, increases the minimum Credit Reserve Ratio etc.

Governments on the other hand, starts to cut down on the expenditure, increase taxes etc.

When these things don't work inflation keeps rising creating hyperinflation, this in turn increases the foreign exchange rates and decreases the value of the currency.

It then gets difficult for the government to borrow external money without paying higher interest rate. This is when things start to turn ugly.

There are only two ways to come out of this situation.

- Austerity - Where government cuts down spending, increases taxes, stalls hiring, reduces salary of its employees etc. As you can see this is not the popular one. Obviously politicians don't like this.

- Running printing press - This is more popular amongst the politicians. You want more money for government spending ? Just ask central bank to print more money for you. This is the most easiest and the most dangerous option.

No prices for guessing, what Mugabe asked his Central Banker to do.

Yeah right.

Just print more money.

Yeah right.

Just print more money.

This is exactly what he said in Feb 2006: "I will print money today so that people can survive."

In 2006, realising that the Zimbabwe Dollar(ZW$) was becoming worthless, they started to print new denominated currencies by chopping off three zeros.

In 2007, ZW$500,000 notes were issued. Salary hike of 900% was given to soldiers

In 2008, they came up with new currencies by chopping off ten zeros from the existing notes, as computers and ATMs failed to handle basic transactions in billions and trillions of dollars. Inflation was 231 million percent a year.

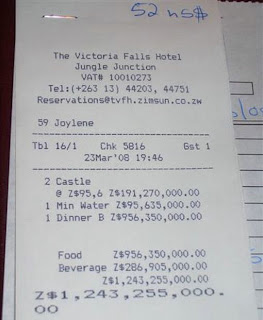

In 2009, ZW$100 trillion was issued. Inflation was just 6.5 quindecillion novemdecillion percent a year (65 followed by 107 zeros)!!. Prices doubled everyday.

Fruits and vegetables were costing no less than billions of dollars.

Fruits and vegetables were costing no less than billions of dollars.

Zimbabwean dollar was thrown to garbage and used as wall papers and toilet papers.

Many who didn't had the access to accepted currencies, were forced to trade only in gold.

In 2008, they came up with new currencies by chopping off ten zeros from the existing notes, as computers and ATMs failed to handle basic transactions in billions and trillions of dollars. Inflation was 231 million percent a year.

In 2009, ZW$100 trillion was issued. Inflation was just 6.5 quindecillion novemdecillion percent a year (65 followed by 107 zeros)!!. Prices doubled everyday.

The country was full of millionaires and billionaires. Kids were playing with millions of Zimbabwean dollars.

Shops were forced to slash prices, which took them out of business. Leading to the long queue of starved people outside empty shops.

Finally the German company, which was assigned the job of printing money stopped to print any more currencies as government couldn't provide them foreign currency to buy ink and special paper required. And people were forced to trade in Gold, Silver, USD, South African Rand, Botswana Pula, Pound Sterling.

Zimbabwean dollar was thrown to garbage and used as wall papers and toilet papers.

Till Date they don't have their own official currency after suspending Zimbabwean dollar, they use USD for all official government transactions.

Old Zimbabwean dollars are nothing more than collection items these days. You can get them here if you want.

Positive thing to note is, things have improved in Zimbabwe in the last four years and future is expected to be much brighter.

As I said earlier, Zimbabwe is just one amongst many countries whose currency disappeared taking millions of families to misery.

Check this presentation video of Timothy D.Terrell for information on other currency collapses.

On a conclusive note, Emerging markets like India have to reduce their dependency on cheap foreign money to fund their deficit. Once money enters the system, it will go out one day or the other, eventually selling home currency. There is no respite till the time countries offset their import cost by the export earnings.

Although Bernanke's move to slowdown printing press is causing some temporary hiccups in emerging markets. It's good for everyone in the long run that we are not going to see the below currency note in the future.